photo credit: Loon Pond

The Financial Times announced announced today that they are partnering with Foursquare. The new deal with the will allow Foursquare users free access to FT.com anytime they update their position in an area or venue near a major financial center or business school.

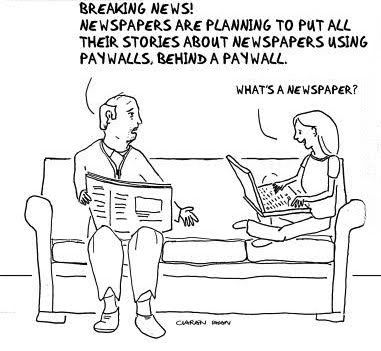

Here’s my thinking: The Financial Times has one of the only successful paywall models. They are a niche-specific publication that has financial information not obtainable elsewhere. Papers in smaller, isolated markets are best positioned to capitalize on a paywall model because of limited competition.

The Financial Times has a relatively small base of 11.4 million unique users. They increased their subscription prices (and it’s pretty hefty) so how does one reach the upcoming generation of business folks?

Hello, interwebs. Hello, social media tools that can make their job easier – and generate revenue.

Major publications, like Newsday, failed at a paywall model with fewer than 100 subscribers and a substantial decline in their online audience.

Here’s the question: Does the demographic that pays for the print subscription of the FT use geolocation services? Or will it open them to an entirely new demographic by building on a successful model foundation?

As their core readership gets older, the FT needs to evaluate how they can tap into the new business generation and encourage them to read their publication. Think of it as a “taste before you read” – if you can subscribe for free at certain places/check-ins, a consumer might want to have it all the time. They also are introducing day passes, which are secret codes redeemable for premium services.

Another interesting point? The publication’s small online reader base is less than one third of their subscribers, but generates 73 percent of their revenue from the digital aspect. (Sidenote: I wonder if FT is working on deals with the chosen venues to generate even more revenue in the form of an ad platform.)

I’m hoping they measure, among much more:

- Percentage increase/decrease with subscriptions (paid and online – 3 mo., 6 mo., 9 mo. increments)

- Percentage comparison of ad revenue v. subscription revenue

- Online revenue (and if increase/decrease)

- Social buyer revenue v. print ad

So, let’s chat. I know this topic will spark interesting ideas from both sides – how strategy can play a role, what they are doing, is this a stunt to be considered cool and buzz-worthy?